11 August Oppenheimer

Eli Harari

[Safe Harbor]

(Skipped Agenda)

As you know SanDisk has the broadest range of products in flash storage. In the center there you can see the imaging and the USB and the Audio/Video. This is what is called our legacy business. Some of that is more mature and has become less price elastic, but even there we see growth. Particularly outside of the United States- in China, India, Latin America. Basically lots of places in APAC [Asia Pacific] that still have a lot of growth ahead.

The biggest opportunity that we see for growth is the mobile. I will talk a little bit more about that and then emerging markets for us the embedded, again mostly mobile and then SSDs. Again I’ll get back to that.

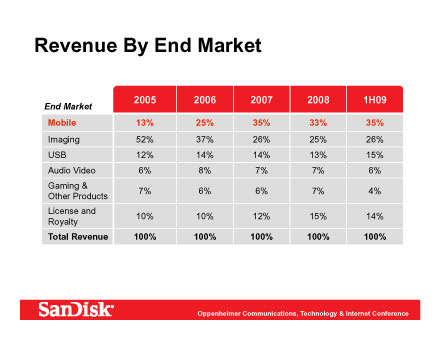

In the first half of 2009, you can see that mobile in terms of revenues was the largest part of our business. In terms of units its actually even more than 35%. You can see that imaging and USB are doing well holding their own. Combined about 45% of the business [including Audio/Video. Gaming was a little bit down, but we see that as returning and of course license and royalty has been 14% in the first half in spite of a weak first quarter.

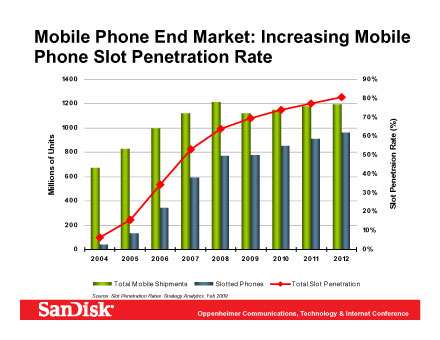

The mobile phone end market is very very strong both for embedded and for removable cards. In the removable card category we believe that microSD has now become the standard and of course there is also the M2 for Sony Ericcson phones which we supply.

The encouraging trend here is that in 2009 we expect more than 70% of all handsets to have a slot for a card. That is close to 800M handsets shipped in 2009 with a card slot and that represents a tremendous opportunity. The attach rate is still relatively low and the smartphones, the iPhone, the Blackberry, the Palm Pre and so on, and of course the Nokia phone, we believe are moving more towards computer-like devices with applications stored and driving the demand.

The Apple 8GB, $99 iPhone is the direction of kind of the baseline requirements on the high end. 8GB is becoming much more accepted in that category.

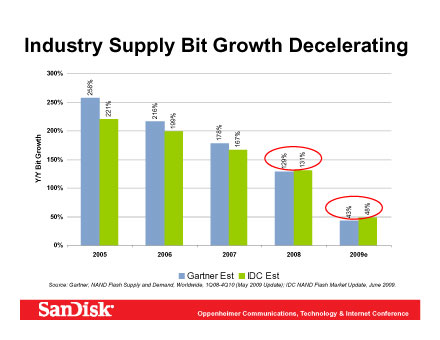

One of the most important developments that the industry has gone through in the last 6 months is a significant deceleration in supply and that has occurred really in the first and second quarters through production cutbacks. Which heretofore, have been unheard of.

As well as delay or defer, basically nobody is talking about new wafer fabs for NAND. So I think things have in Q4 of last year has become very very difficult in the industry, and there was really no other direction to go, but to cutback.

SanDisk was the first to take that move. We announced late in Q4 that we decided to cut back in Q1 by 30%. Others followed.

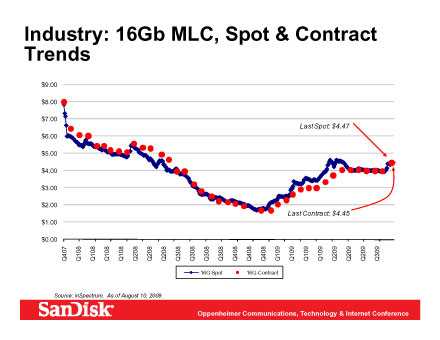

As a result we’ve seen pricing initially firm up, and then continue to rise and more recently we have stabilized.

What you are seeing here, the source is inSpecturm, updated through late July. You can see the spot price for 16Gb, 2GB MLC is about $4.47. Contract price about the same [$4.45]. That is more than double what it was at the end of Q4, and basically what it was about a year ago. So we have gone in pricing where we were about a year ago. As you can see the price at least in the last three months has been quite stable.

This is really quite unprecedented. The industry has gotten used to relentless cost reductions with price reductions. By the Q4 last year there was excess supply, excess inventories and the price reductions far exceeded cost reductions resulting in significant losses for all participants.

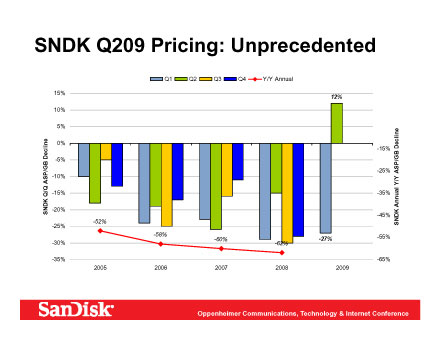

You can see the positive impact for us of pricing rising. What I’m showing you here is every quarter for the last five years, 4 1/2 years. The ASP declines that SanDisk experienced on a quarterly basis and the red line is on an annual basis.

And you can see, its always negative, every quarter price reductions coming in, supported to a large extent by cost reductions, but not completely.

In 2008 you can see that price reductions are really cumulatively adding up to 62%. Deprived us of all profitability. Things started improving, though it is difficult to see here in the first quarter of 2009 and definitely on the upswing in Q2 of 2009.

So the trend is definitely moving in the right direction.

Of course the flip side of higher prices is that demand in terms of MBs/unit and even the number of units slows down. We know that elasticity works both ways. But we are very focused on profitability. This is our #1 concern right now.

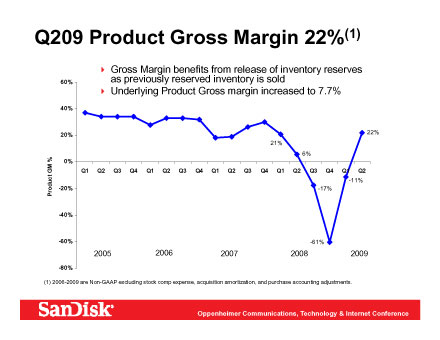

This one is looking at SanDisk’s Product Gross Margins through the second quarter. You can see that we had 2005, 2006, and 2007- good steady product gross margins in the range of 30 to 34% or so, 35% and then in 2008 things started deteriorating primarily because of the excess supply that came about from everybody mastering MLC- everybody in the industry mastering MLC. Lots of 300mm capacity coming on stream and very very productive technology migrations.

So by Q4 [2008] you can see pretty much a disaster scenario- excess supply and people really dumping at the end of the quarter. Excess inventory way below cost and at that point I think that it was very clear that, to us at least, that we really need to cut back with the global economy slowing down.

Anyway it was the right decision, and we took it at the right time. We also took very aggressive steps in restructuring the company.

Cutting quite substantially our operating expenses. Restructuring our supply agreement, or rather our joint venture agreement with Toshiba. Selling back to Toshiba in Q1 slightly over 20% of our captive capacity. As a result of that we have been able to gain much better control of our destiny, and really focus on the business that makes sense, the profitable higher margin business, frankly walking away from business that in Q4 and Q3 of last year with excess inventory we had to go after.

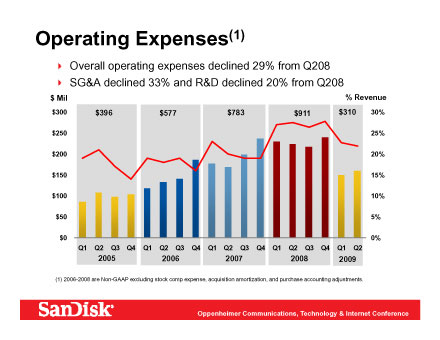

You can see here our operating expenses really coming down very dramatically in 2009. Some of that came through layoffs about 12% of the company, very very tight controls on expenses but of course maintaining our spending on strategic programs, our core competencies, our advanced technology roadmap both in NAND and 3D R/W, controllers and systems.

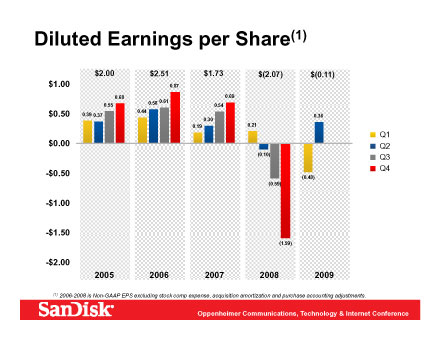

You can see from this slide here that the diluted earnings per share, the bottom line here is that, BTW this is non-GAAP numbers, you can see in the second quarter, we had our first profitable quarter since the first quarter of 2008. This is very very good. Its heading in the right direction. It kind of demonstrates that Q4 was probably the bottom of the current prolonged downturn.

We see the downturn as really having started in the Q4 2007 and I think the worst is over and that’s basically the reason for our cautious optimism for the second half of the year.

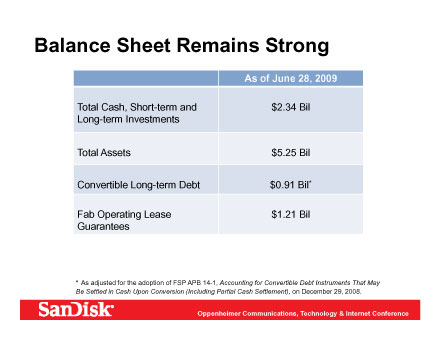

In terms of the balance sheet, the balance sheet is very strong now. Through this restructuring of our joint venture with Toshiba, we were able to very substantially reduce our fab operating lease guarantees from over $2 billion, $2.1B to $1.2B and through cutting our capex from what was planned to be $1.6B down to about $500M. We were able to dramatically improve our cash position, our assets and so on. So I am very very pleased. Really very pleased with where we are today in terms of our balance sheet and our preparedness in the next up cycle.

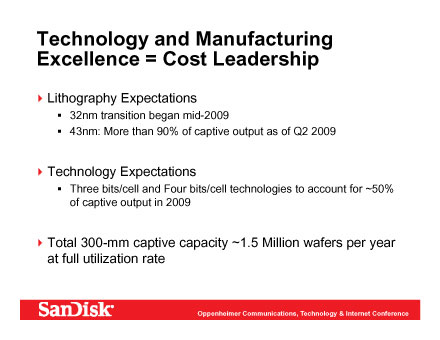

As far as what to expect on the technology migration. Lithography-wise we began the 32nm transition. Its looking good. We expect it to take several quarters to fully convert from 43nm to 32nm and that will carry 2 and 3 bits per cell.

43 nm is today the production workhorse. We expect slightly over 50% of our total output this year to be in three bits and 4 bits. 4 bits is a small part of that, but still shipping in production and in that regard we believe we are ahead of the industry in introduction of 3 and 4 bits per cell. We think it is going to happen industry-wide, but we think we have perhaps one generation head start.

We started with 3 bits per cell with 56nm technology. At 43nm it has been our production workhorse and we expect the same for 32nm.

All in all, after we completed the restructuring with Toshiba, we have about 1.5 million 300mm wafers per year. That is our total capacity. All of it is leading edge. All of it is capable of 32nm technology and beyond and we think that this is a very very substantial amount of capacity on the captive side.

I estimate that the total number of wafers 300mm equivalent for the industry is in the range of 8 million wafers for the year. So that is 1.5 million out of 8. It is quite substantial.

It certainly allows us to focus both on the OEM side and the retail side and of course we have stated many times that we would like to move beyond this captive supply and leverage our non-captive supply agreements with Toshiba, Samsung and Hynix. In the future we will need additional supply to move in the direction of leveraging that supply to reduce our capex investments.

The growth opportunities again that we see- mobile handsets we do believe will be the #1 engine of growth for the flash industry in the next 5 years or so and we are very very well positioned in that.

Very strong in removable cards and getting stronger by the day in embedded OEM business. I am very very pleased with the progress that we are making there and the design wins that we have seen.

Legacy end markets. That is mostly retail. We are holding our own, but again, focussing very very much on profitability- even if it means sacrificing market share in markets where we don’t see the profits.

On emerging markets we see really two significant opportunities: Slot radio, slot media, slot music are basically physical media for content distribution particularly for handsets. There are billions of handsets out there that really cannot play a CD or a DVD and we think the medium for those is microSD.

SSD of course is a major emerging market. There really we are very strong on the low end, what we call modularized systems, pSSD.

And beginning to address the enterprise with what we call managed NAND.

On the notebook SSD which is the 3G products, I’ve said before, we’re not where we need to be today, however I would say that this market is still very very young and in terms of bottom line implications it should be very minimal. Being late to market at this stage is financially not an issue.

Technically we need to catch up and I believe we will.

And then the IP. We have signed an agreement with Samsung. I am very pleased to have that in place for the next seven years. I do believe that our IP is very powerful. It has a lot of very significant IP in the area of storage systems/ SSD, security, and of course 3D R/W.

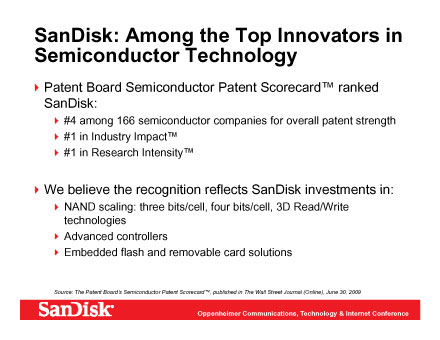

In just the last month or so, the Wall Street Journal published a semiconductor patent scorecard, which is an independent agency. Anyway, we are now #4 among 166 semiconductor companies for overall patent strength and more importantly #1 in industry impact and #1 in research intensity. That is very very good. We are a very good company, these are major semiconductor companies.

And I believe that is because we are very passionate about pursuing NAND to its scaling limits, driving the logical scaling in 3 bits and 4 bits per cell. And of course a very strong investment in 3D Read/Write, advanced controllers, embedded flash and removable card solutions, security and so on.

So we really are relentlessly of course driving this technology

So in summary, the industry demand/supply, I believe, is in better balance today than in any time in the last four years and we are seeing that with the pricing in the market, that allows the return of profitability and for ourselves definitely creating a much more healthy environment for growth for us. I am very pleased with that particularly given the fact that we are still in the midst of a global recession.

Second quarter results clearly indicate a very positive momentum that we are gathering from our very decisive actions in Q4 and in Q1 restructuring ourselves and restructuring the joint venture.

But we really see the very powerful impact of production cutbacks across the industry on returning stability to the industry.

SanDisk is very well positioned I believe in the mobile space. We are getting new designs in the embedded OEMs. Very focused on profitable growth and balance sheet strength through holding pricing where possible, raising pricing, continuing to drive costs down, product costs, operating costs and lower capex.

So we remain cautiously optimistic for the second half of 2009 and I will open it up now for questions.

Q&A

Q: Thanks Eli. I’ll kick it off. Can you help us understand near term fundamentals I know it is difficult .. back to school sales and seasonal second half. But, just in terms of how things are lining up. I’d just like to get a better understanding of what I think of as pretty muted expectations of bit growth in the September quarter. Its not only in terms of your guidance, but most everybody else like Hynix and Samsung, their commentary on bit growth for the September quarter was also muted. Historically the September quarter has been pretty decent in terms of bit growth. This is clearly not 100% bit growth across the course of the year for the industry, but historically it has been somewhere around 25 to 30%. I think you guys are talking about single digits, so what has changed, if anything and what kind of drives that cautiousness. Is there excess inventory out in the distribution channel that drives that cautiousness?

Eli: I think it is really still just the uncertainty as far as the economy and particularly the Q4 holiday sales season. People are very cautious about that. Really if you take a look at Q2. Q2 our bit growth also did not grow the way we expected.

Q: But higher prices.

Eli: That’s right. Still Q2, Moms, grads, mother’s day and so on, also was muted. Definitely in the US. It is very difficult to say if the sales by Q4 is going to have an impact and people are going to go to the store and buy at what we expect. I think that is really the underlying reason for cautiousness.

It is not pessimism. It is really much more on the side of optimism because supply and demand are pretty well balanced with the exception of some inventory that was sold in Q4 at incredibly low prices. Still you can see some of that in the market.

Q: Let me just follow on to that question about pricing..You were obviously pretty disciplined pricing .If you look here at the beginning of the September quarter, you see a lot of prepayment activity. a lot of longer term contracts being struck I guess,

Are we in a much better pricing environment in September and how does the prepayment activity, not only from Apple but also from … as well . How does that drive the quarter to quarter improvement in pricing…?

Eli: I think in general demand overall for the industry keeps growing. There is no question about it. Particularly in the mobile environment. So the underlying dynamics is growing demand. Its not taking off- its not exploding, but it is definitely moving in the right direction. And its global.

And it is very very diffused. There are many many industries that absolutely need NAND. The pricing in many cases has reached the point where it doesn’t need to go any lower. It has matched consumer price points. If you lower it any further, you are not going to sell any more. And retailers understand that.

On the supply side there is no question that the supply is limited to what’s in place right now. And the profitability is still not there to warrant going out on a capex spree and building the next fab. I don’t think that that is in the cards anytime in the next several quarters.

I can tell you for ourselves we certainly don’t feel that today the ROI is there to build the next fab. It will take several good quarters of improved corporate profitability beyond what it is today before we would be even thinking about that.

So I think that the environment is stable and very very much moving in the direction of a much more healthy balance than we have seen in 2008.

Q: [Mostly inaudible] Can you talk a little bit about.. SSDs.

The question is on SSD and where we are in that market and how we see it.

I believe that SSD eventually will be, eventually let’s say 5 years out, will be between a third to a half of the total consumption of NAND flash. NAND or maybe at that time, 3D.

In other words, its going to grow from nothing to a very very substantial part of the market. And as far as technical difficulties, of mastering the performance requirements- endurance and so on – the industry and ourselves will obviously master that.

There is no gotchas, no .. [inaudible]we just have to get it right, we have gotten it right in some parts, but not on other parts. But where we haven’t gotten it right, we will get it right.

Again its not rocket science. And we do have the know-how in the company. We just need to make sure that we get it right.

So the real issue is the economics of SSD. In the enterprise space, people are prepared to pay for the value, for the performance, the crash resistance, the very high IOPs, the low power and that is why the enterprise space looks very promising.

In both the netbook and the notebook there is this perception that NAND flash has got to match more or less the cost of hard disk drives even though at a lower density. And to achieve that in the next two years or so requires selling SSD at a loss and we are not prepared to do so. SanDisk is not prepared to subsidize that market.

That is because we have other opportunities where we don’t have to do that. We will prioritize those opportunities. Particularly in mobile where we are very very strong. We do see tremendous demand and where we don’t have to compete with the cost structure of HDDs.

There is no HDD that can go into a mobile phone.

For the SSD business to really take off, outside of enterprise. Enterprise as I’ve said is a profitable, but niche market. It will not move a lot of GBs, relatively speaking. Where a lot of GBs are going to move in SSD in the future is going to be in notebooks, desktops, and netbooks.

And there flash memory offers 10X the performance, far lower power dissipation (?), far smaller form factor, very reliable and I believe that once consumers start using it they will not want to go back to disk drives- ever.

But its the chicken and the egg and I believe that consumers will be prepared to pay for the value that they are getting. Today there is this perception that there is no value to SSD other than meeting the price point of hard disk drives. So long as that is the case, I think that we are just going to delay the introduction of the SSD.

Eventually it will happen because it really gives you a very compelling value proposition and the technology cost reduction that we see for SSDs, for flash memory, basically is saying look either you pay us for the value that we bring so we can justify investment in new capacity or you don’t. In which case you are just going to have to wait until the cost reductions get to the point that it becomes profitable.

Q [inaudible]

Eli: Niche does not necessarily mean small. It will be neither small nor unprofitable. But all I’m saying is that it will not need a lot of capacity. It will not move a lot of GBs.

I think that STEC has done a very good job- several years back basically recognizing that market. They have been totally focused on that.

Our focus frankly is on mobile. We are very very focused on mobile. I’m not saying that SSD is not important. But you’ve got to pick your front runners.

SSD will eventually be important enough for us, but today mobile really is where we see the greatest opportunity for us.

Now, the play for us I believe in enterprise is to deliver very high quality NAND flash, managed NAND, and let the STECs of the world and a hundred other players out there that want to explore the play in the enterprise, use our supply- supply of very high quality, very well tested, and very high performance flash memory.

Because frankly anybody that is in the enterprise space that wants to adopt flash will want to have in the supply chain a very good, reliable, captive supply, and there’s not too many of those around.

That’s really the direction we are going. We’re not ignoring the enterprise. But today, clearly we’re not there.

Question [inaudible]

Eli: The question is about back to school and of course we can’t comment in the middle of the quarter. I will say that it is kind of spotty. I mean there are some chains are doing very very well and some that are conversely are not doing well. And that’s in the United States.

In general I would say this is pretty much a global market and overall, things are cautiously optimistic.

Question [inaudible]

Eli: Today, the vast majority of our mobile shipments are in cards. And in cards, the direction is to move from basically regular cards to cards that use the intelligence of the controller to provide launchable applications. The card itself uses its intelligence.

The SDC, service delivery card. We think that that is a highly differentiated card, even though it looks like a microSD.

In the embedded, the main thing now is that the industry is kind of now settling on an embedded format, eMMC 4.3, 4.4, JEDEC and the flash industry has worked on this eMMC.

Our claim to fame if you will in that is that we have been the first to drive for bootability from that device using an MLC flash memory. This is part of the msystems’ legacy. MDOC was a bootable device.

And that is catching on for high capacity. Multi chip packages were used, mobile DRAM, is usually for very low storage capacities, 128 MB, 256 MB and so on. When you are looking at embedded 8GB, 16, 32 GB, eMMC I believe is the right way to go.

The industry is kind of adopting that. And we are doing very well in that, in terms of design wins and I believe it will become a substantial business for us.

Question [inaudible]

Eli: It should be about the same. The GMs should be about the same.

Q: … I think you guys mentioned that the gross margin number [in the long term] you’d like to reach was somewhere around 20%.

Eli: No, 20 to 30%.

Q: OK in the 20% range.

Eli: I’d like to get it higher of course.

Q: You are somewhere around 8% right now. What needs to happen from today through 2010 that could get you there?

Eli: First of all the markets as I said, are growing. We need to have differentiated products, like SDC for example.

Q: Does the market need to grow back at 100% per year?

Eli: No, you need to have good demand/ supply balance. This is very sensitive. I mean the things that drove pricing up by a factor of 100% was a 5% imbalance in favor of demand. The demand was 5% higher than supply. The prices doubled.

Likewise last year there was 5% excess supply and prices plunged. So there really needs to be a good balance between demand and supply.

And we continue our cost reduction. That is the one thing that is under our control and we expect to continue to do well.

However, flash is slowing down and flash cost reductions are not going to continue at the rate that we have seen in the last 3 to 4 years. The last 3 to 4 years cost reductions annually have been 50 to 55% annually. That will slow down quite substantially over the next 3 to 4 years, because of Moore’s Law.

Pricing has got to come down at a much slower rate than what we have experienced in the past for profitability to return and for the margins to approach the 20 to 30% net GMs, not including any kind of inventory reversals or anything of that nature. And I believe that that is possible, because of the inherent growth.

Question [inaudible]

Eli: The ramp of 3 bits is proceeding basically as I said. I think in the second quarter we were at 45% or so of bits shipped- three bits per cell.

Question [inaudible]

Eli: Good question. I’ll give you an idea. We said that for the year, the total number of bits will be around 50%, which means in the second half of the year it has to be higher than the first half.

In principle its all about qualifying customers and making sure that the application, that the performance of three bits fits the application. For the vast majority of the applications, that is the case.

So as far as I am concerned three bits now has become the mainstream technology and cost factor for the 43nm. Now we have to prove that, that’s the same for 32nm.

Question [inaudible]

Yes, but I don’t frankly know that number. From the 45% to whatever it is [pause].

Question [inaudible]

Eli: We have said that for this year we expect our total bit growth, 2009, to be under 50%. And that is through technology transitions. 43nm and going to three bits per cell. The next technology transition will be 32nm both two and three bits per cell.

Typically in a technology transition like that you can expect between 30 and 50% more bits. You cannot expect 100%. You have to put in place new capacity for new wafers if you want to go above 50%. That’s true not just for SanDisk, its true for any other supplier.